Impact of Rising Interest Rates, Urbanization and Technology on the Future of Real Estate

The real estate market is changing fast, and there’s a lot to talk about! With rising interest rates making us rethink how much we can spend on homes, and technology turning house hunting into an exciting online experience, it’s a busy time for buyers and investors. Whether you’re looking for your dream home, thinking about investing, or just curious about the latest trends, this is for you. Cities are growing quickly, and finding a good place to live can feel like a fun adventure. Let’s explore how these changes are affecting the housing market easy to understand and relatable!

Rising Interest Rates and Their Impact on Real Estate

The Reserve Bank of India’s (RBI) decision to raise interest rates has notable consequences for the housing market. As interest rates climb, borrowing costs for home loans rise, making it more expensive for individuals to purchase homes. However, the effects of these changes can differ based on several key factors.

Buyer’s Financial Situation

Individuals with solid financial standings, such as those with higher incomes or lower debt-to-income ratios, are typically more resilient to rising interest rates. For such buyers, the increased monthly payments due to higher interest rates might not severely impact their ability to afford a home. On the other hand, buyers with lower financial stability might struggle to secure loans or manage higher mortgage payments.

Property Prices

The impact of rising interest rates can be balanced by property prices. If property prices remain stable or even decrease in certain markets, this can mitigate the effect of higher borrowing costs, making homes more affordable even with higher interest rates. In contrast, in markets where prices are rapidly increasing, higher interest rates can significantly reduce affordability.

Government Policies

Government intervention can play a crucial role in cushioning the blow of rising interest rates on the housing market. Policies such as tax breaks, interest rate subsidies, or incentives for first-time homebuyers can help offset the financial burden on buyers and stimulate demand in the housing sector.

Affordable Housing Initiatives and Their Effectiveness

Government initiatives like the Pradhan Mantri Awas Yojana (PMAY) have been instrumental in promoting homeownership among low- and middle-income groups. However, the success of these affordable housing initiatives depends on several critical factors.

Availability of Affordable Land

One of the biggest hurdles to affordable housing is the limited availability of reasonably priced land, particularly in urban areas where demand is highest. The scarcity of affordable land in cities makes it difficult to develop housing projects at lower costs, which can impede the expansion of affordable housing.

Government Subsidies

The level and accessibility of government subsidies can have a significant impact on the reach of affordable housing schemes. If subsidies are high and eligibility criteria are broad, more people can benefit from these initiatives. However, limited subsidies and restrictive criteria may reduce the effectiveness of such programs.

Infrastructure Development

The success of affordable housing projects is often tied to the surrounding infrastructure. Even if housing is affordable, the absence of essential amenities like transportation, healthcare, and educational facilities can reduce the desirability and long-term viability of these developments.

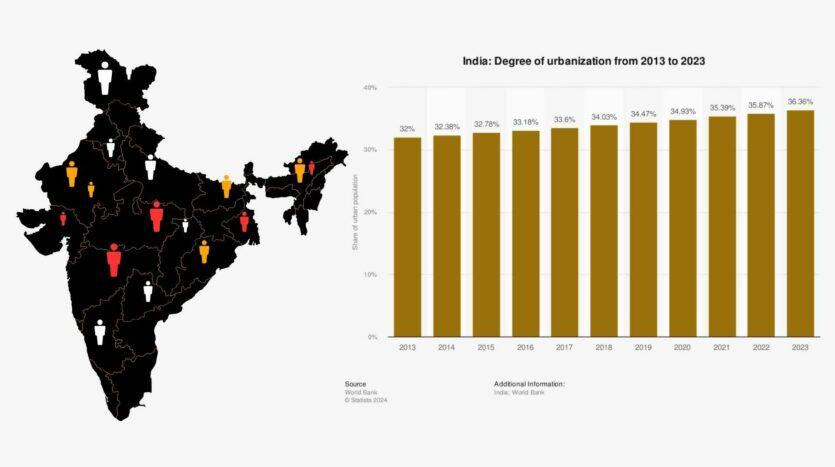

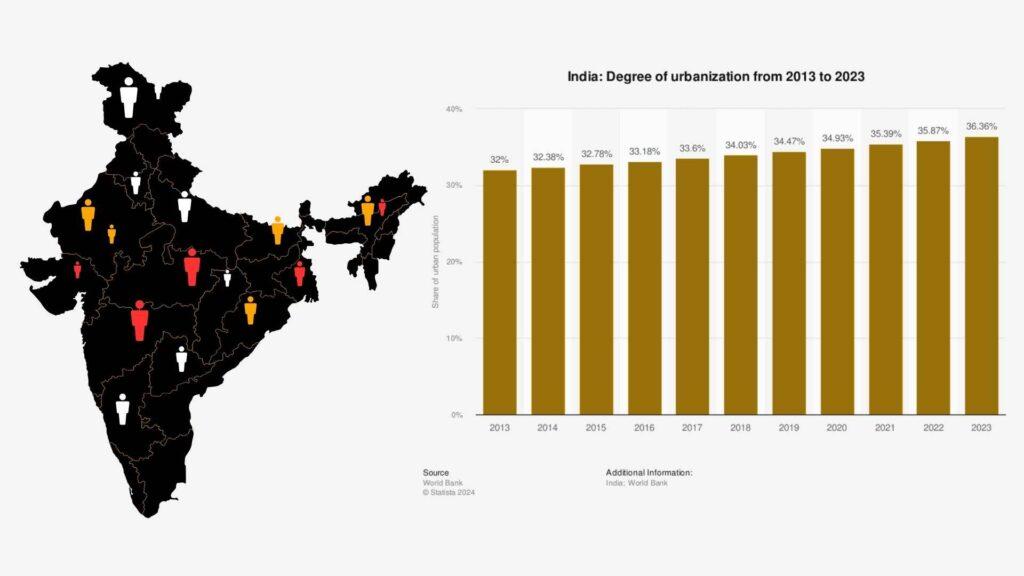

Urbanization and Migration Trends in India

India’s rapid urbanization, driven by migration from rural to urban areas, has led to increased demand for housing, particularly in metropolitan cities. This trend is expected to continue due to several reasons.

Economic Opportunities

Cities offer more job opportunities and better economic prospects than rural areas, making them an attractive destination for rural migrants. This influx of people creates a growing demand for housing in urban centers, putting pressure on city infrastructure and housing supply.

Better Infrastructure

Urban areas generally have superior infrastructure, including better transportation networks, healthcare systems, and educational institutions. These amenities make cities more attractive to individuals and families looking to improve their quality of life.

Lifestyle Preferences

Many people are drawn to the modern lifestyle and conveniences offered by cities, such as entertainment options, shopping centers, and cultural activities. As a result, migration to cities is not only driven by economic factors but also by lifestyle preferences.

Infrastructure Development and Its Impact on Real Estate

Government investments in infrastructure, including transportation, connectivity, and urban development, can profoundly influence the real estate market. Improved infrastructure offers multiple benefits

Increase in Property Values

Properties located in areas with excellent infrastructure, such as roads, public transportation, and utilities, tend to appreciate in value over time. Buyers are willing to pay a premium for the convenience and accessibility that good infrastructure provides.

Attracting Buyers

Infrastructure projects, like the development of metro lines, highways, or business hubs, can make previously underdeveloped areas more attractive to homebuyers and investors. As connectivity improves, demand for housing in these regions rises, often leading to a real estate boom.

Stimulating Economic Growth

Infrastructure projects create jobs and boost local economies, which can lead to greater demand for commercial and residential real estate. As businesses flourish and more people move to areas with improved infrastructure, the real estate market benefits from increased activity.

Technological Advancements in the Real Estate Sector

Technological advancements, particularly in property technology (PropTech), are transforming the way real estate transactions are conducted. These innovations are making the market more accessible and efficient for both buyers and sellers

Improving Efficiency

PropTech tools, such as online property listings, virtual tours, and automated valuation models, help streamline the home-buying process. Buyers can now browse properties, compare prices, and take virtual tours from the comfort of their homes, making the search for a new home faster and more efficient.

Increasing Transparency

Online real estate platforms provide more transparency into property listings, market trends, and pricing data. Buyers and sellers have greater access to information, which helps them make more informed decisions. This transparency helps build trust in the market and reduces the potential for fraud or misinformation.

Reducing Costs

PropTech solutions can help reduce transaction costs by cutting out intermediaries, such as brokers or agents, and enabling direct communication between buyers and sellers. Additionally, these platforms often offer competitive fees, making real estate transactions more affordable.

Conclusion

The real estate market is influenced by many important factors like interest rates, government policies, migration patterns, infrastructure development, and new technologies. As interest rates go up, buyers and investors need to carefully look at their finances. Government programs for affordable housing are there to help low- and middle-income families find homes. At the same time, rapid urbanization is increasing the demand for housing in cities, and improvements in infrastructure are important for real estate prices. Technology is also changing how people buy and sell homes, making the process faster, clearer, and cheaper. Understanding these factors can help buyers, investors, and policymakers make smarter decisions.

Frequently Asked Questions

How do rising interest rates affect home buyers in India?

What are government initiatives for affordable housing?

Why is urbanization increasing housing demand in cities?

How does infrastructure development influence real estate prices?

What technological advancements are changing real estate transactions?

What should buyers do to prepare for rising interest rates?

What are the benefits of affordable housing programs?

How does migration impact the real estate market?

Why is transparency important in real estate transactions?

How can understanding real estate trends benefit investors?

Investing in real estate can come with various risks, from market fluctuations to property management challenges. At Hari Hara Properties, we ensure that all your property needs are fully taken care of, offering expert guidance and management. With us, you can invest with confidence, knowing that your real estate journey is backed by a team dedicated to minimizing risks and maximizing returns.